In the intricate dance of real estate transactions, buyers frequently lean on the Property Tax Assessed Value as a compass for a home’s market value. However, as a seasoned realtor, I often witness this metric wielded with undue confidence, guiding buyers toward low offers under the assumption that the assessed value accurately mirrors market reality. Let’s delve into why relying on Property Tax Assessments as a yardstick for market value can be a perilous endeavor.

The Annual Ritual of Property Tax Assessments

Property Tax Assessments in British Columbia unfold on a yearly cadence, orchestrated by BC Assessment:

- July 1st of the previous year: Estimated assessed values for most properties are established.

- Oct 31st of the previous year: The assessed value aims to encapsulate the physical condition and permitted use of the property as of this date.

- January of the current year: Property assessment notices are disseminated.

- February 2nd of the current year: The deadline for filing a notice of complaint for the assessment.

- February 3rd to March 15th: Hearings convene to address complaints.

- Spring of the current year: Municipalities set tax rates.

- July 2nd of the current year: Property taxes become due.

Observations on the Assessment Process:

- Assessed Value and Assessors’ Constraints: Assessments, conducted by a limited number of assessors in the BC Assessment office, transpire only once a year. Considering the sheer volume of assessments, each assessor’s interaction with an individual property is minimal. With thousands of assessments to process, time constraints are evident.

- The Database Dilemma: BC Assessment urges homeowners to update their property details in the online database called e-value BC. While statistical information is pivotal, two ostensibly similar properties may exhibit significant disparities, rendering statistical analysis insufficient. How many homes do assessors physically visit before conducting an assessment?

- Pressures of Public Perception: In a bid to maintain an up-to-date database, BC Assessment relies on homeowners to voluntarily update property details. However, the extent to which homeowners engage with or are even aware of this database raises questions about its efficacy.

- Flaws in Predicting Modesty: Assessors may issue press releases indicating modest changes in assessed values. However, the perception of modesty can be subjective, and a +10% change in a year may not align with everyone’s definition of modest. Did you like the article? Read also about the New Definition of Success: Quality of Life vs. Standard of Living.

The Illusion of Homogeneity: Luxury Homes and Assessments

In certain segments of the Comox Valley real estate market, homes may indeed sell close to their assessed value, such as the case with typical split-level homes in Comox. However, the disparity widens in other segments, notably waterfront listings, where assessed values can deviate significantly.

A Cautionary Tale: Statistical Analysis Gone Awry

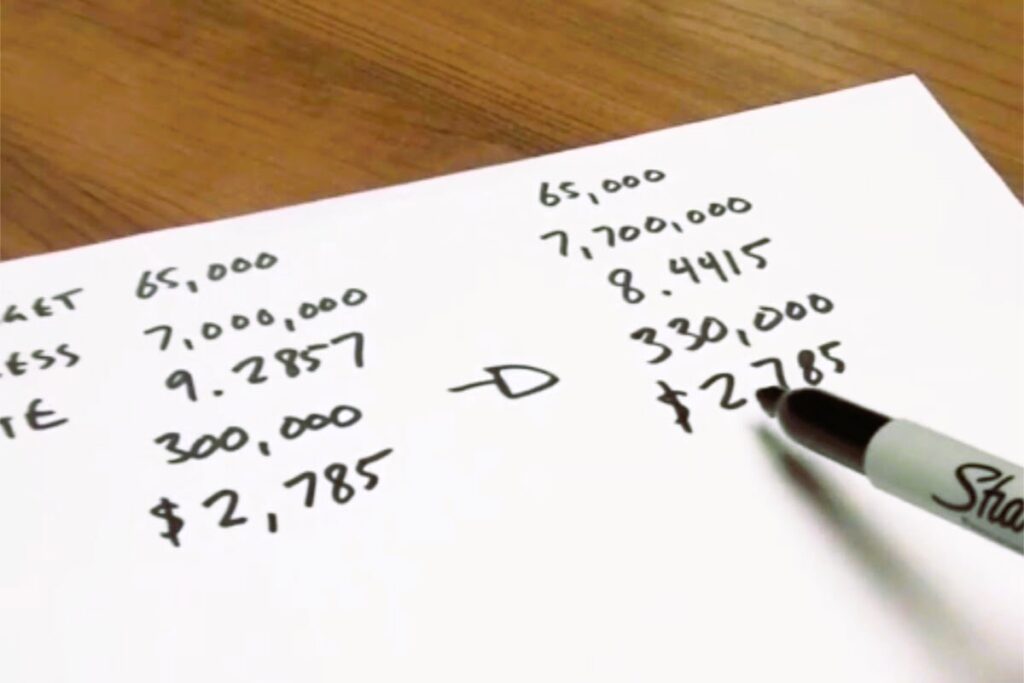

A recent scenario exemplifies the pitfalls of over-relying on statistical analysis and tax assessments. A buyer sought to formulate an offer based on a comprehensive statistical analysis, claiming that most homes in the Comox Valley sold close to assessed value. However, an examination of comparable sales revealed a stark reality: only 3 out of 17 similar homes sold within 5% of their assessed values. The other 14 spanned between $40K and $120K over their assessed values. For additional resources on Canadian home buying standards, please visit Canada.ca.

Market Value: The Unwavering Metric

While Property Tax Assessments serve a purpose, especially in determining property tax amounts, they fall short as a reliable metric for market value. The inherent flaws in the assessment process, coupled with individual homeowners’ influence on the database, underscore the need for caution when relying on these figures. In the realm of home valuations, Market Value emerges as the unwavering metric, representing the reasonable expected price a home might fetch in an open market. Even with its challenges, seeking the insights of experienced, knowledgeable realtors remains crucial for accurate market valuations, especially in the dynamic and localized Comox Valley real estate market. For precise market advice, turn to the Brett Cairns real estate team.